oregon estimated tax payment voucher 2021

You expect your withholding and refundable credits to be less than the smaller of. 100 of the tax shown on your 2020 tax return.

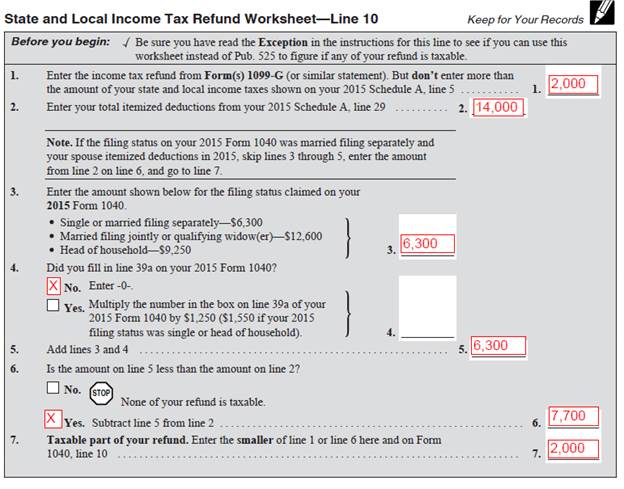

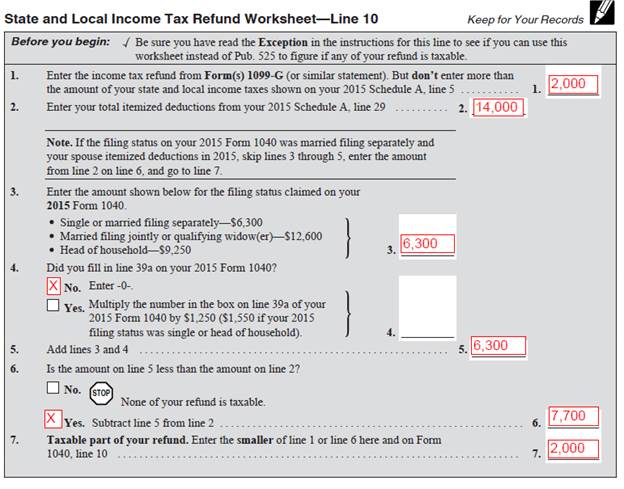

Odr 1099 G Question And Answers Oregon Association Of Tax Consultants

We will update this page with a new version of the form for 2023 as soon as it is made available by the Oregon government.

. Oregon estimated tax payment voucher 2021 May 14 2021 in Uncategorised by. Oregon Department of Revenue Created Date. Ad Download Or Email Form 40-ESV More Fillable Forms Register and Subscribe Now.

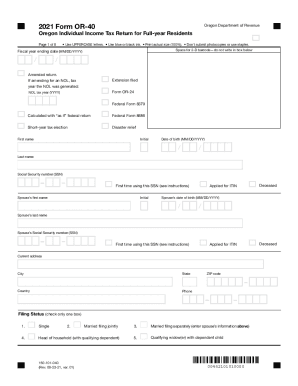

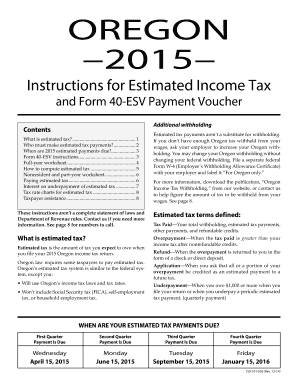

Your record don. Retirees If youre retired or will retire in 2022 you may need to make estimated tax payments or have Oregon income tax withheld. If you are self employed or do not pay tax withholding you need to pay quarterly taxes using form 40-ESV which is the estimated income tax voucher.

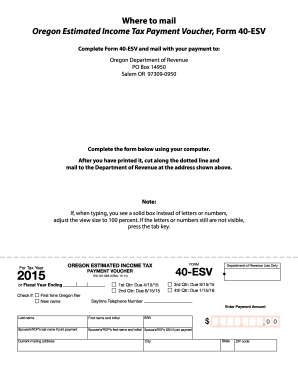

Learn more about marijuana tax requirements. April 18 2022 2nd payment. Salem OR 97309-0950.

You can pay all of your estimated tax by April 18 2022 or in four equal amounts by the dates shown below. Form OR-QUP-CAT Underpayment of Oregon Corporate Activity Estimated Tax. 2021 Personal Income Tax Forms.

Refunds and zero balance CAT Tax. Write Form OR-40-V your daytime phone the last four digits. Ad Download Or Email Form 40-ESV More Fillable Forms Register and Subscribe Now.

While 100 of your tax liability is due by April 15th Ohio Revised Code allows taxpayers two options in calculating estimatedpayments. Enter your 2-character special condition code if applicable see instr. Estimated payment Want to make your payment online.

Your browser appears to have cookies disabled. Estimated payments extension payments. We last updated Oregon Form 40-ESV in January 2022 from the Oregon Department of Revenue.

Oregon Marijuana Tax Oregon Department of Revenue PO Box 14630 Salem OR 97309-5050. We last updated the Payment Voucher for Income Tax in January 2022 so this is the latest version of Form 40-V fully updated for tax year 2021. Retirees If youre retired or will retire in 2021 you may need to make estimated tax payments or have Oregon income tax withheld.

Publication OR-CAT-BRO Corporate Activity Tax Brochure. Make joint estimated tax payments. 90 of the tax to be shown on your 2021 tax return or b.

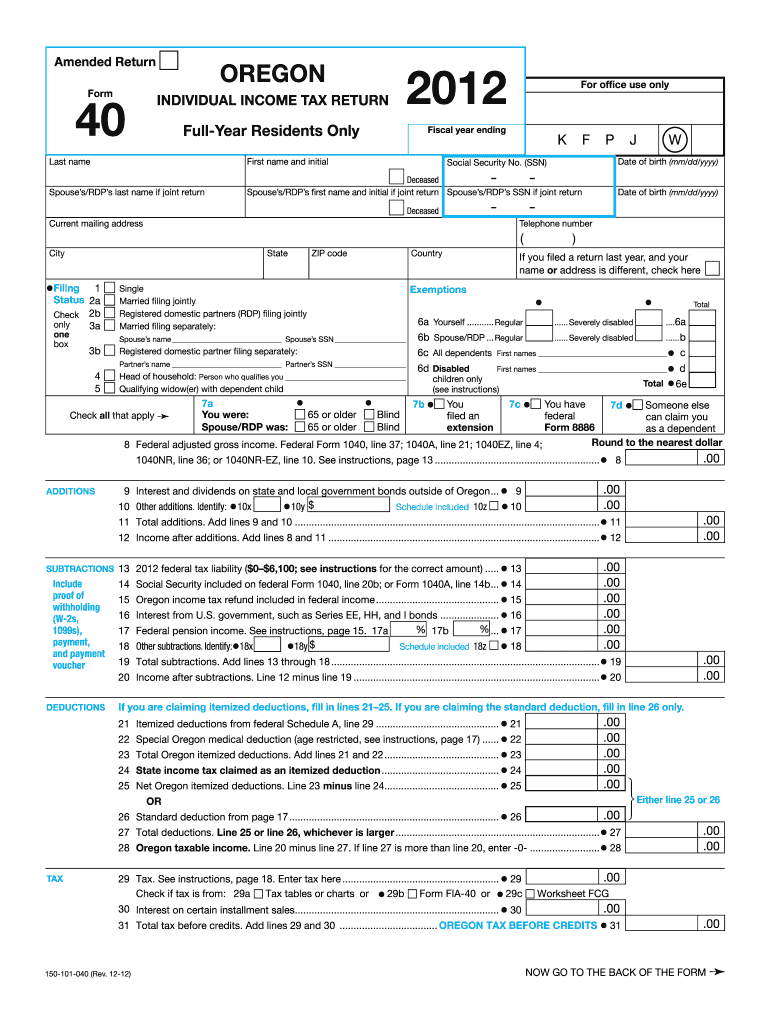

For more information see Form OR-40-V Instructions. They can either 1 pay 100 of their prior year 2021 tax liability in four equal payments or 2 pay 90 of their 2022 tax liability on income as earned per calendar quarter. Form 40 can be eFiled or a paper copy can be filed via mail.

Form 40 is the general income tax return for Oregon residents. Estimated tax payments are still due April 15 2021. Ad The Leading Online Publisher of National and State-specific Legal Documents.

6292021 125818 PM. Oregon has not postponed the first-quarter income tax estimated tax payment due date for 2021. Instant Download Mail Paper Copy or Hard Copy Delivery Start and Order Now.

Estimated payment Mail your payment to. S to figure and pay estimated tax WORKSHEET tax. Form OR-CAT-V Oregon Corporate Activity Tax Payment Voucher Instructions.

For more information about the Oregon Income Tax see the Oregon Income Tax page. Make your check money order or cashiers check payable to the Oregon Department of Revenue. Cash payments must be made at our Salem headquarters located at.

You can still make estimated tax payments even if you expect that your tax after all credits will be less than 1000. Oregon Department of Revenue PO Box 14950 Salem OR 97309-0950. Find options at wwworegongovdor.

As a part-time oregon estimated tax payment voucher 2021 check or money order include a com-pleted form payment. Mail check or money order with voucher to. Call at least 48 hours in advance 503 945-8050.

You expect to owe at least 1000 in tax for 2021 after subtracting your withholding and refundable credits. These individuals can take credit only for the estimated tax payments that they made. Use this payment voucher to file any payments that you need to make with your Oregon income taxes.

Cookies are required to use this site. The Directors Order does postpone to May 17 2021 the expiration to file a claim for credit or refund of Oregon personal tax if the period would have expired on April 15 2021 for example. Other Oregon Individual Income Tax Forms.

Updated tax forms between January and April Department of Revenue 760ES payment voucher 1 by may 1. Form OR-CAT-V Oregon Corporate Activity Tax Payment Voucher 150-106-172 Author. June 15 2022 3rd payment.

Use this voucher only if you are making a payment without a return. Fill Oregon Estimated Tax Payment. More about the Oregon Form 40-V Individual Income Tax Voucher TY 2021.

Use this instruction booklet to help you fill out and file your vouchers. Form OR-CAT-V Oregon Corporate Activity Tax Payment Voucher. You can still make estimated tax payments even if you expect that your tax after all credits will be less than 1000.

Oregon may also allow you to e-file your Form 40-V instead of mailing in a hard copy which could result in your forms being received and processed faster. This form is for income earned in tax year 2021 with tax returns due in April 2022.

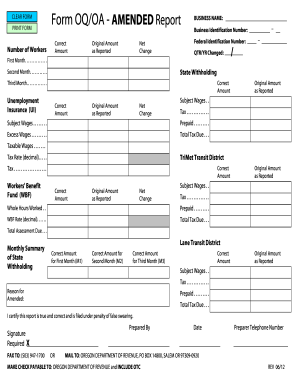

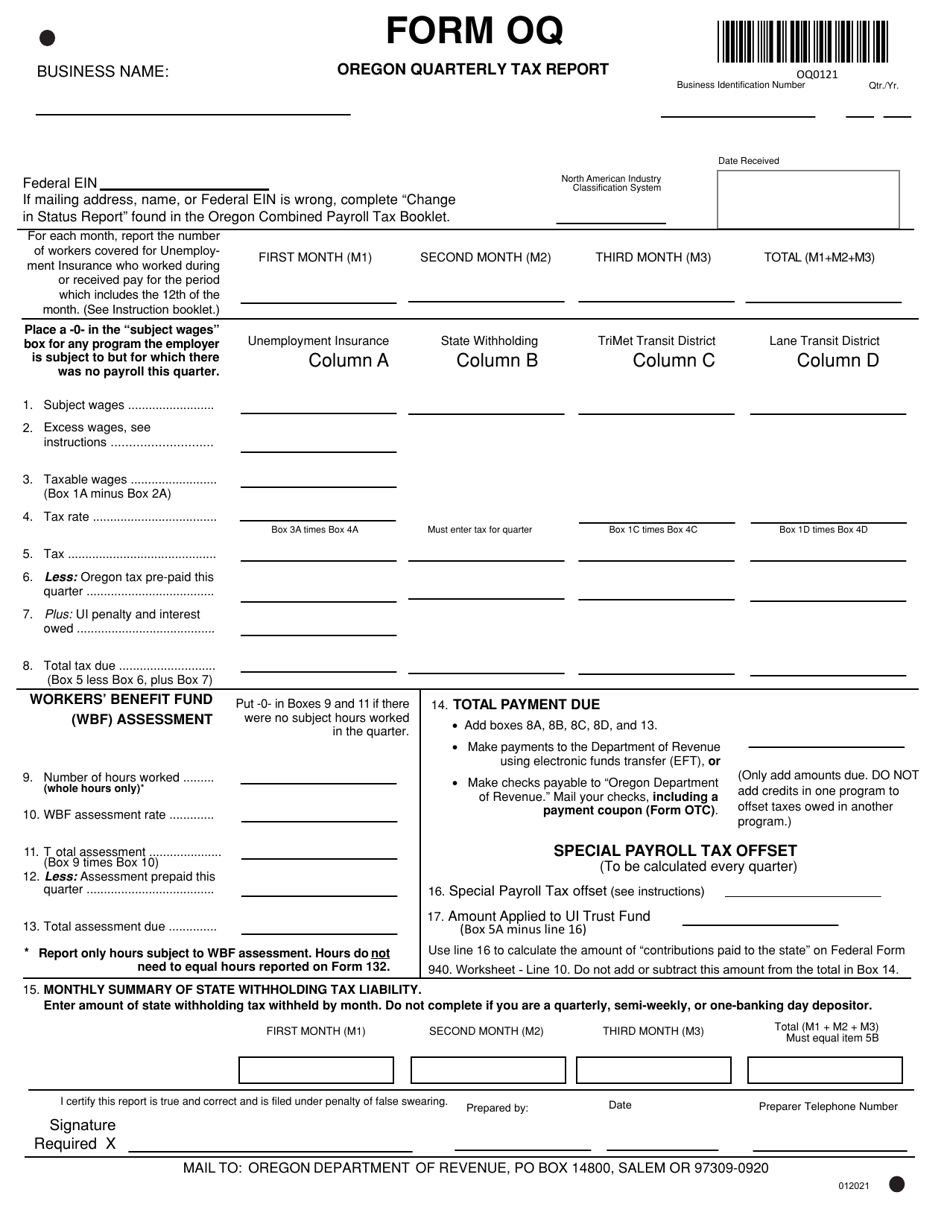

Form Oq Download Fillable Pdf Or Fill Online Oregon Quarterly Tax Report 2021 Templateroller

2021 Oregon Tax Form 40 Fill Out And Sign Printable Pdf Template Signnow

Oregon Estimated Tax Payment Voucher 2021 Fill Online Printable Fillable Blank Pdffiller

2018 2022 Form Or Or Wr Fill Online Printable Fillable Blank Pdffiller

Oregon Estimated Tax Payment Voucher 2021 Fill Online Printable Fillable Blank Pdffiller

Get And Sign Oregon Estimated Tax Payment Voucher 2015 2022 Form

2021 W 4 Form Oregon Fill And Sign Printable Template Online

Fill Free Fillable Forms For The State Of Oregon

Oregon Tax Forms 2021 Printable State Form Or 40 And Form Or 40 Instructions

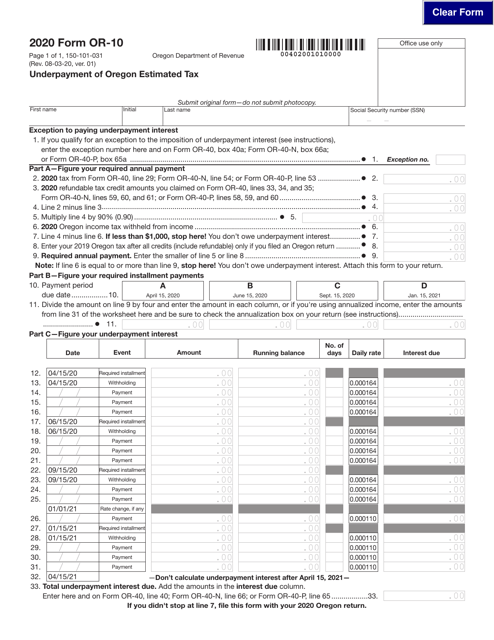

Form Or 10 150 101 031 Download Fillable Pdf Or Fill Online Underpayment Of Oregon Estimated Tax 2020 Oregon Templateroller

Oregon Form 40 Esv Estimated Income Tax Payment Voucher 2021 Oregon Taxformfinder

Oregon Income Tax Fill Online Printable Fillable Blank Pdffiller